What in the World is My Money Doing?

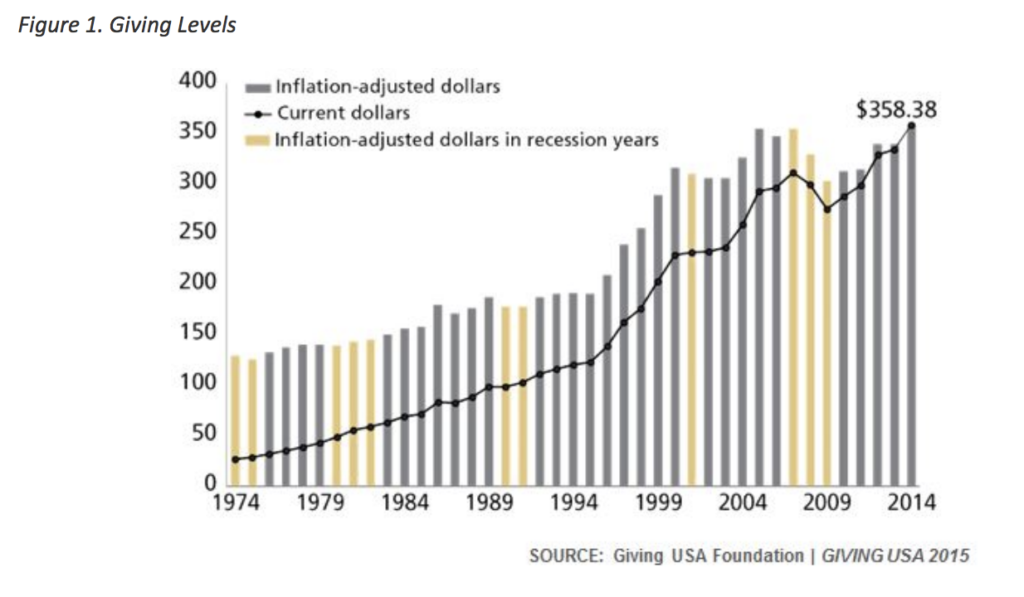

Philanthropy in the United States is growing across the board, with giving levels approaching pre‐market crash annual totals. In fact, recent evidence suggests that giving money away is no longer enough for a growing group of investors. This cohort wants to know that, once allocated, their money will both fill a specific social need and continue to grow. During the last 5 years, assets managed for responsible impact have grown to close to $3.74 billion dollars. The line between philanthropy and responsible investing is starting to blur, and capitalism is increasingly driving social change. Out of a total $33 trillion of assets under management in the United States, approximately $1 out of every $7 dollars is invested using responsible investing practices.

The progression from socially‐responsible to impact investing

While investing with an eye toward avoiding specific sectors has grown dramatically, it is not a new approach. In Colonial times, some religious groups would not invest their excess funds to support the slave trade. In 1921, Pioneer Group launched a mutual fund to screen out tobacco, alcohol, and gambling investments. Socially responsible investing continued to grow through the civil rights and anti‐war movements of the 1960s and 70s. The 1980s saw the introduction of the “Sullivan principles,” named for the African‐American preacher Reverend Leon Sullivan, which promoted corporate social responsibility and screened out investments that supported apartheid in South Africa.

The responsible mandate has recently expanded to include issues of workplace diversity, the environment, and corporate responsibility. These areas of focus can now be captured using Environmental, Social and Governance (ESG) screening tools. Using “negative screens” in ESG, investors are able to filter out specific investment sectors, such as tobacco. The ESG serves as a central factor in measuring the sustainability and ethical impact of an investment in a company or business. In this way, investors can go beyond profits and financial statements and evaluate investment products as corporate citizens.

Impact Investing Today

The field of “impact investing” falls somewhere between philanthropy and traditional for‐profit investing. Unlike a donation or grant, there is an expectation of a return from the investment. Yet it is quite different from a traditional for‐profit investment. According to the Case Foundation, impact investments are “those made into companies, organizations, and funds with the intention to generate measureable social and environmental impact alongside financial returns.”1 The concept, sometimes called double bottom line, creates a social good alongside an investor return. With impact investments, returns and societal benefit are not mutually exclusive.

1‐ From “A Short Guide to Impact Investing” The Case Foundation, October 2015, CaseFoundation.org

What type of companies do impact investors buy?

The actual investments vary greatly, in accordance with the mandate of the fund. Many of the companies eligible for investment are certified as “B Corps” by the nonprofit B Lab, an organization that applies rigorous standards of social and environmental performance, accountability, and transparency to identify businesses that initiate a positive social impact. B Corp certification is to business what Fair Trade certification is to coffee, or USDA Organic certification is to milk. At the most recent count, there were roughly 1500 B Corps in over 42 countries, and this number is growing. Companies can be public or private, derive from different geographies, and are at different stages of the business cycle.

But Can Profits and Good Works Coexist?

Many investors assume that using social responsibility implications as investment criteria would result in

concessionary returns. While this is a relatively new field, the data demonstrates that this is not the case. Returns are, in fact, quite favorable. One firm with a particularly interesting strategy is Generation Investment Management. Based in London, Generation is run by David Blood and Al Gore. Over the last ten years, they have quietly practiced what the firm refers to as “sustainable capitalism”. They evaluate and rank companies’ business practices and management teams on a variety of social and environmental factors. Their investment thesis suggests companies that maximize their financial return by strategically managing their economic, social, and environmental performance will create long‐term shareholder value.

In fact, for the 10‐year period from June 2005 to June 2015, the MSCI World Index, a widely accepted measure of global stock‐market performance, showed an overall average growth rate of 7 percent annually within Generation’s funds. According to Mercer2, a prominent analytical firm, the average pre‐fee return for the global-equity managers it surveys was 7.7 percent. However, through that same period the average return for Generation’s global‐equity fund, in which nearly all its assets are invested, was 12.1 percent a year, or more than 500 basis points above the MSCI index’s growth rate. Of the more than 200 global‐equity managers in the survey, Generation’s 10‐year average ranked as No. 2. In addition to being nearly the highest‐returning fund, Generation’s global‐equity fund was among the least volatile.

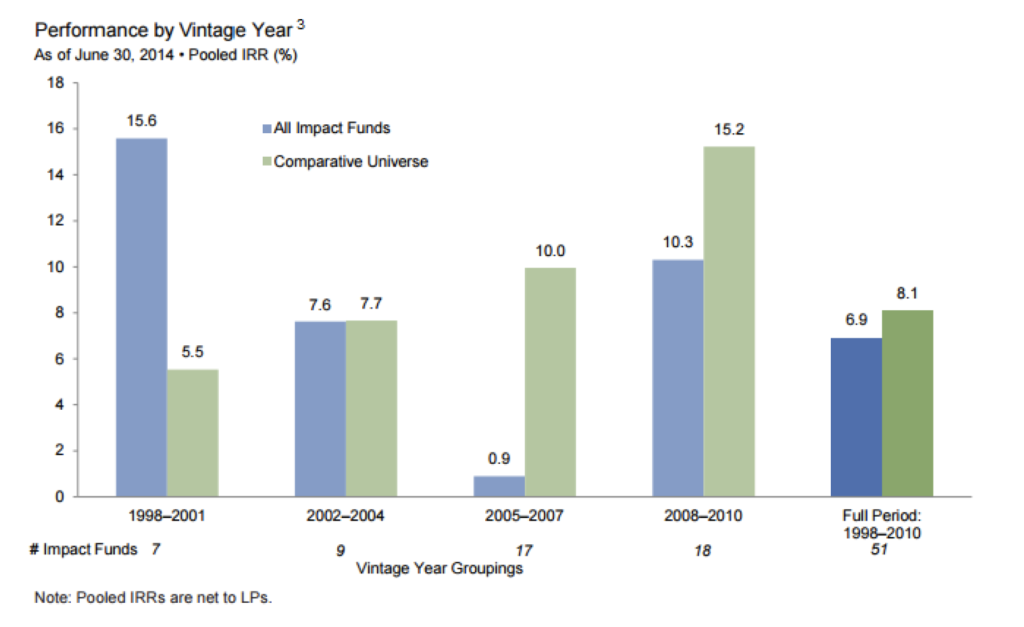

For a broader sample, Cambridge Associates, the world’s largest consultant to endowments and foundations, and the Global Impact Investing Network have collaborated to launch the Impact Investing Benchmark, the first comprehensive analysis of the financial performance of private equity and venture capital impact investing funds. The Impact Investing Benchmark comprises 51 private investment funds3. These investments are made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return. The intention to generate measurable social or environmental impact puts an explicit focus on positive impact, which distinguishes the practice from the “negative screens” used in ESG and socially responsible investing (SRI).

2‐ From “Research Perspectives”, June 2014 ‐ http://www.mercer.com/

3‐ These private investment funds are for high‐net‐worth investors (HNWI) on ly.

Summary Performance

Across all vintage years, the pooled internal rate of return for the Impact Investing Benchmark is 6.9%,

compared to 8.1% for funds in the comparative universe (see Performance by Vintage Year chart below). Relative performance differs significantly by vintage year. Impact investing funds launched between 1998 and 2004 performed in line or better than funds in the comparative universe, while impact investing funds launched between 2005 and 2010 have lagged. Furthermore, the funds within the Impact Investing Benchmark exhibited a smaller standard deviation. In other words, the actual performance outcomes were closer to the expected return than to the comparative universe4.

4‐ From “Introducing the Impact Investing Benchmark ‐ 2015” Copyright © 2015 by Cambridge Associates LLC. All rights reserved. Cambridge Associates (CA) and the Global Impact Investing Network (GIIN) note that this report is provided for informational purposes only. The information presented is not intended to be investment advice.

Conclusions

Traditional efforts to address social and environmental problems have been driven by government intervention and non‐profit funding. Impact investing, by leveraging profit motives, is emerging as an additional viable methodology to effect social and environmental change. Because many investors are looking beyond traditional risk and return and are factoring social impact and responsibility into the evaluation of their investments, the field of impact investment is on the rise. In response, corporate pragmatism is incenting more companies to consider adopting socially responsible business practices, promote strategies and solutions to attract the social impact segment, and create wider investment options and more targeted products. As it matures, impact investing will offer investors ever‐increasing opportunities to do well by doing good.